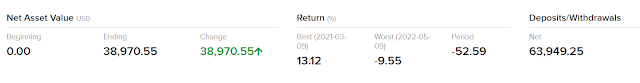

I started with a SGD1K account and progressively top up to a SGD87K account.

I started my investing and trading journey in the month of August 2020. To mark this 2 years journey, I have decided to pen down this milestone so that if you stumbled upon this page and would like to try out investing or trading in future, you will avoid the mistakes that I have made and make you a more savvy investor or trader than I first started.

To be specific, I started this journey almost the same time when the stock market recovered fully from the Covid-19 low. It was a period when time was of abundance and the country was under Covid-19 lockdown and all I could do at home was to watch Netflix and more Netflix... After 3 months of slacking around at home and pondering about the meaning of life, I happened to meet a secondary school friend who was already digging his hands into investment and trading way before Covid-19. With an insight into the stock market, my friend was quick to take action when the stock market came crashing. With his experience, he was able to maneuvered his way out of losing more than 40% due to the Covid crash to making more than over 100% when the market recovered shortly. He suggested to me that perhaps it was time for me to start taking action for myself as business was slow and I have always wanted to "try out" the money market.

I started my trading account after the market has recovered 100% from the Covid crash.

Under his guidance and advice, I took my first step and went into investing and trading. Since then, I have never look back. Yes, I lost 39% of my initial investment, hard cash, hard earn money... but did I regretted starting? Absolutely NOT! In fact, I regretted not starting earlier. I say this because many regular investors and traders alike would say the same thing. It is funny because, I have never appreciated the advice of starting earlier. I don't understand why regular investor or trader always tell people to start as early as they can. I am always skeptical when it comes to the snake oil man trying to me his snake oil even though it might be good for me. To me, there is no free lunch in the world and why would anyone want to help me? Why would anyone want to guide me? Why would anyone want to see me doing well? The answer is simple because they care. There is a saying if someone is selling you something and there is no product, then you are the product. Technically, it is not wrong but since we are living in a world of information, all it takes is for one to look for the answers on the internet. These days a lot of people got scam because they simply do not want to fact check. They believe the hearsay and listen to fairy tales ending and was sold a dream of success. The fact is, no hard work means no success and this is the same for trading. I too, was lured by the get rich quick mentality only to find out that this is not sustainable. The best investment that you can give to yourself is to invest in yourself. There was a research done by the University London College and they found out that it takes 21 weeks for a habit to be formed. Trust me, it was not easy, I had to stay wide awake every single night from the start of the trading bell. My night involves starring a chart patterns, reading latest news, search for entry opportunities, watching trading videos on Youtube, studying financial reports, there are just so many things to do. Trading and investing is NOT easy if you want to do it seriously.

How do I feel after losing 39% of my portfolio? Honestly, I feel hopeful. I am feeling hopeful because I appreciate what the stock market can do for me when I am old and on my way to retirement. I am hopeful because I know that after spending 2 years crafting my trading and investing skills, there are still a lot more to learn. I am hopeful because I see this as a way out of the usual rat race when one has to report to work with KPIs to meet. I feel hopeful because I know this is what I wanted. And of course, I feel hopeful because there is money to be made from the stock market and only if you know how.

To know how, you need to take action and start learning.

Along this journey, I have made some silly mistakes and I will list down my top 8 mistakes in this blog so that you can totally avoid them or at the very least be wary of them so that you can invest and trade better.

1) Don't listen to hearsay - When I first started, I did the easy way one. I watched many Youtube videos watching investment gurus giving free advice on what stock to buy and guess what? I bought them and till today, I am still holding onto some of these unrealized losses. Hold your on views on all your entries, just because someone says it is a good stock to have in your portfolio, it might not be. As enticing as they may sound, you need to form your own purchasing views. Gurus you see online does not care about your money more than you do.

2) Have a plan - Plan your entries, plan your exit. You need to have a plan, the easiest part about entering a position is to click the BUY button but the most important button to click is actually the exit button. They say, if you fail to plan, you plan to fail. Things to consider when entering a trade can make or break your account. When are you buying? When are you selling? What do you buy? How much do you buy? When do you buy?

3) Show hand - If you want to win a war, you need to have resources to last the entire duration of the war. Portfolio allocation is one of the most fundamentals skill to investing and trading but many have burnt their hands in many ways. The stock market works like a roller coaster, it goes up and down accordingly to earnings reports or macroeconomics changes, when your money run out and a great opportunity comes along for you to enter from a low buying position from a stock's fair value, you are unable to activate this war chest. Always keep 20% to 30% of your portfolio untouched while waiting for a black swan day. Don't go 100%.

4) FOMO - The Fear Of Missing Out can be fatal to your account if you are always chasing the high when you missed out buying the low. Always remember that whatever that goes up MUST come. If one wants to be a good trader or investor, one needs to possess the virtues of being patient and discipline. Do not chase the high and always buy the low. Though some would tell you to buy the high and sell the higher, this takes a bit of experience to analyze chart patterns, as a beginner, just follow the buy low sell high rule. The stock market will always be around, if you missed the chance, it is okay to walk away and look for another ticker. While the boat has left, the sea will always be around.

5) Not knowing the platform well is going to leave you slow in taking a position. Know the platform well enough, set up multiple screens if you need to. This helps with quick referencing. If you are trading, it is important to have many screens showing different indicators and charts so that you can react swiftly to the ups and downs. Allowing yourself to access the broker platform well also helps your to eradicate unnecessary information around it. When you see the numbers jump, your heart starts to pump.

6) Stop Loss - For the record, I do not put a stop loss for my investments into the long horizon. I always believe that investment is for the long term, understand that you are buying into the future of the company and you need to adopt a long term view of the ticker. I choose not to put a stop loss simply because investment is not about making the quick money. Even if the stock has fallen to 60% (which I have a few stubborn ones), I will also maintain my long term horizon. Once the winter is over, spring is just around the corner. The stock market especially the index is design for the market to keep going up!

7) Education is important in investing and trading. One can never stop learning and there is always something new in the market. I know of investors who are keen to try out investing but choose not to educate themselves to know more about how the stock market moves. When educated, one makes a better and informed decision over his/her action and remains accountable. If in luck, one can make money not know how the stock market is going but if one is unlucky, the heads will roll in a fast and furious mode without a chance for you to understand the how's and the why's.

8) Find a mentor. As much as I like to say that trading and investing is a man's sole responsibility when one pulls the trigger, finding mentor can short cut all the unnecessary mistakes and save a hellish ride. Find someone who has been there and done it. Paying for courses could be an easier way to kickstart though some can be expensive. We all go through primary and secondary school to become where we are today. Are those classes free? Know that paying someone to teach you is a common thing that we do in our daily life.

About The Contributor

Ben is not financially trained. He is not a certified financial planner and he does not sell any insurance or investment plans. He is not financially motivated by any entities to produce this blog. He just want his friends to know more about money management and not have anyone fall between the social cracks. Nope, he is not a millionaire though he aims to be financially free before 50 years old.

Comments

Post a Comment